Introduction: Solar Cell Manufacturing in India

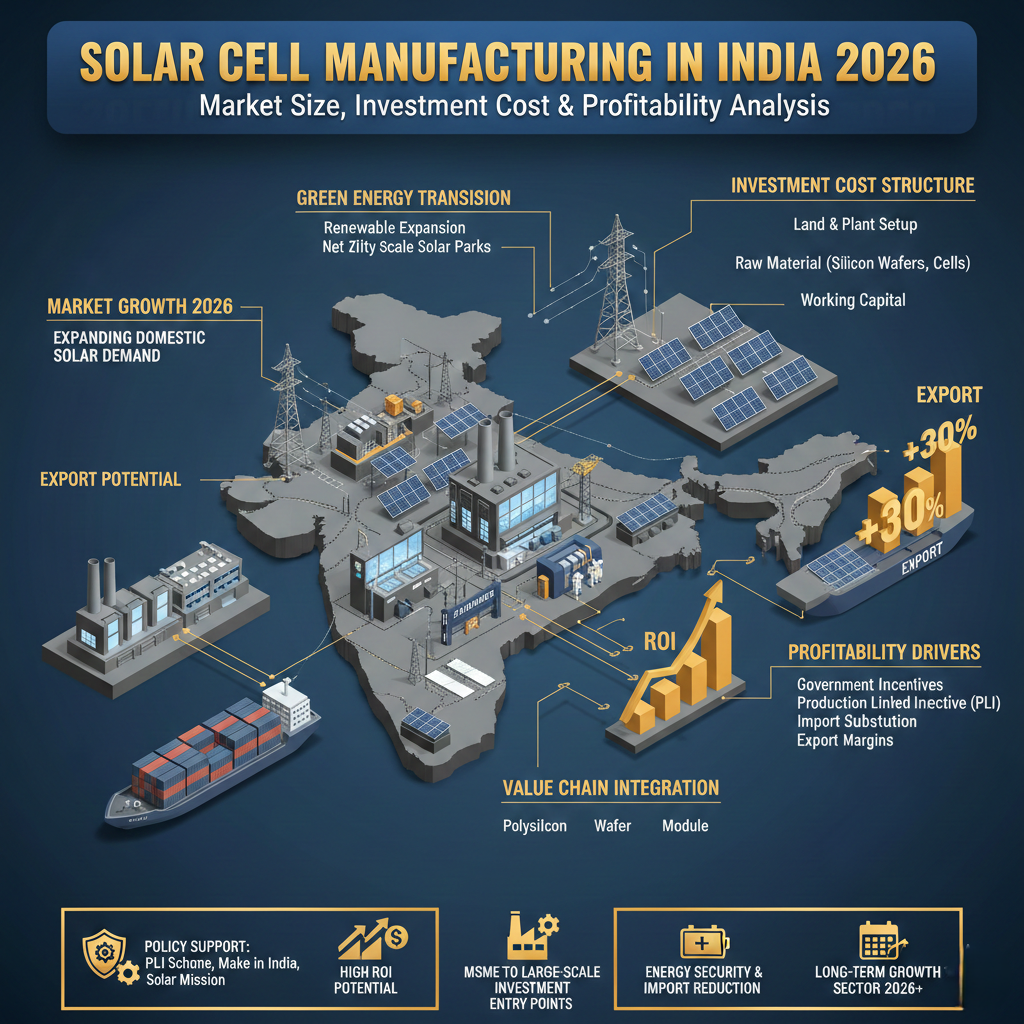

India’s renewable energy transformation now has entered a decisive phase with solar energy emerging as the core of India’s clean energy strategy. Over the past 10 years, India’s installed solar capacity has risen from under 3 GW to over 135 GW, one of the fastest growing markets in the world.

Under the policy direction of the Ministry of New and Renewable Energy (MNRE), not only is India getting installations moving forward, it is ramping up domestic solar manufacturing. With some ambitious renewable targets, strategic trade policies and financial incentives, solar cell manufacturing is becoming a high growth industrial sector.

This report offers in-depth outlook for the solar cells market size, share, growth drivers, technology trends, investment and future opportunities in India for 2026.

Contents

- 1 India Solar Cells Market Size in 2026

- 2 Important Growth Factors of Indian Solar Cells Industry

- 3 Technology Trends Impacting Solar Cell Market

- 4 Competitive Landscape

- 5 Major Industries Participants

- 6 Competitive Strategies

- 7 Investment Requirements and Profitability Study

- 8 Profitability Drivers

- 9 Emerging Business Opportunities in the Solar Ecosystem

- 10 Risks and Challenges

- 11 Future Outlook: 2026–2030

- 12 Conclusion

- 13 Frequently Asked Questions (FAQ)

Read More: Solar PV Power and Solar Products Handbook

India Solar Cells Market Size in 2026

India’s solar industry is growing at an industrial level. The country has already over crossed 135 GW of installed solar capacity and is aiming to reach 500 GW of non-fossil fuel energy capacity by 2030 with solar contributing close to 300 GW.

Existing Manufacturing Capacity Overview

- Solar Module Manufacturing Capacity: ~100 GW

- Solar Cell Manufacturing Capacity: ~35 – 40 GW

- Wafer Manufacturing Capacity: Limited and growing

- Import Dependence: Heavy import dependency on wafers & select high efficiency cells

The massive difference between the module and cell manufacturing capacity shows there is high potential for investments. As domestically the cell production starts to grow, India can not only reduce imports, but also achieve energy security and become an export-oriented manufacturing base.

By 2026, India’s solar cell market is anticipated to grow at a healthy CAGR, backed by policy support, local demand, and global diversification of the supply chain.(Solar Cell Manufacturing in India)

Important Growth Factors of Indian Solar Cells Industry

1. Government Incentives and Policy Support

The main force which drives solar manufacturing expansion in India operates through the Production-Linked Incentive (PLI) scheme. The program provides rewards to companies based on their domestic value creation and their use of advanced technology that delivers better results.

The Approved List of Models and Manufacturers (ALMM) policy ensures that government projects must select certified local manufacturers as their primary suppliers. The requirement of increased local production for solar cells and modules leads to heightened demand for their manufacturing.

The import duty that applies to solar cells and modules creates advantages for local manufacturers because it improves their ability to compete with international products.

2. Rapid Growth in Power Demand

The industrial growth and urban development of India has created a substantial rise in electricity requirements. Businesses in both industrial and commercial sectors use rooftop solar systems as a method to cut electricity expenses while meeting their environmental, social, and governance (ESG) requirements.

The demand for advanced manufacturing technologies to produce rooftop solar installations exists because high efficiency cells require Mono PERC and Topcon production methods.(Solar Cell Manufacturing in India)

3. Utility-Scale Solar Parks

States such as Rajasthan and Gujarat have developed into major solar centers because they possess optimal land resources and excellent solar energy potential and established handling facilities.

Large-scale solar parks are generating predictable procurement pipelines into the multiple gigawatt range, year after year. This consistency makes the demand for solar cells visible in the long term and ensures demand visibility for solar cell manufacturers.(Solar Cell Manufacturing in India)

Read More: India Solar Glass Market

4. Global Supply Chain Diversification

With the international markets eager to find alternatives to single-country dependency, India has become a creditable manufacturing destination. Western countries are diversifying more and more in sourcing, and it is opening up opportunities for export for Indian solar cell producers.

Manufacturers who have international certifications and high efficiency production lines stand to benefit greatly from this shift.(Solar Cell Manufacturing in India)

Technology Trends Impacting Solar Cell Market

Technology choice is important in competitiveness and profitability.

1. Mono PERC (Passivated Emitter And Rear Contact)

Mono PERC has become the reference technology for high efficiency production technology in India. It provides better efficiency than traditional multi-crystalline cells and still has a manageable capital investment requirement.

2. Topcon (Tunnel Oxide Passivated Contact)

Topcon technology is receiving rapid adoption because of its higher efficiency and improved performance in large-scale solar projects. It enables manufacturers to charge premium prices especially in export markets.

3. Heterojunction (HJT)

HJT cells offer very high efficiency at the expense of higher capital expenditure and special equipment. While still emerging in India, HJT is the next stage of premium solar manufacturing.

4. Emerging Perovskite Tandem Cells

Although still in the development stage, perovskite tandem technology can promise great efficiency improvements. Investment in R&D partnership by Indian manufacturers might provide early mover advantages in this segment.(Solar Cell Manufacturing in India)

Competitive Landscape

India’s solar manufacturing ecosystem has large conglomerates and specialized players.

Major Industries Participants

- Adani Solar

- Reliance Industries

- Vikram Solar

- Warre Energies

The companies pursue aggressive capacity expansion plans, while several companies implement a strategy to control their production process from wafer manufacturing through to module creation.(Solar Cell Manufacturing in India)

Competitive Strategies

Successful manufacturers are usually focused on:

- Large scale capacity for cost advantages

- Technology upgrades to keep up efficiency leadership

- Vertical integration to better margins

- Export diversification

- Strong domestic distribution networks

New companies face challenges when they attempt to provide affordable products because they struggle to compete on that factor. The company should choose to focus on three specific areas which include niche market segments and product excellence and comprehensive service delivery according to the target market needs.(Solar Cell Manufacturing in India)

Investment Requirements and Profitability Study

Solar cell production is capital intensive.

Estimated Investment

The cost of establishing a 1 GW solar cell manufacturing facility depends on the chosen production technology which requires a substantial financial investment. The primary cost elements consist of the following factors:

- Production line machinery

- Cleanroom and plant infrastructure

- Utilities and power backup

- Skilled workforce

- Working capital

The two advanced technologies Topcon and HJT require higher initial costs but they deliver superior financial returns throughout their operational period.(Solar Cell Manufacturing in India)

Profitability Drivers

To be profitable for solar cell manufacturing depends on:

1.Economies of Scale – As the plant gets larger, the cost per unit is lower.

2.High Plant Utilization – Steady orders guarantee cost optimization.

3.Efficient Raw Material Procurement – Controlling the price volatility of wafer is critical.

4.Government Incentives – PLI benefits help to improve returns.

5.Vertical Integration – Reduces supply chain risks & improve margins.

Margins in the commodity areas can be fairly thin and operational excellence and cost control are paramount.(Solar Cell Manufacturing in India)

Emerging Business Opportunities in the Solar Ecosystem

The solar value chain goes far beyond the production of cells.

- Solar Glass Manufacturing

Bifacial modules have special needs for low iron tempered glass providing opportunities for domestic manufacture.

- Component Manufacturing

Opportunities exist in:

- Back sheets

- Junction boxes

- Mounting structures

- Aluminium frames

These segments are more attractive to MSMEs.

- Solar EPC Services

Engineering, procurement and construction types of services are also growing with the demand for installation and provide lower capital entry services.

- Solar Module Recycling

As early solar projects reach the end-of-life, recycling of silicon, glass and precious metals will be an important industry segment.

Risks and Challenges

Despite the good growth prospects, there are certain risks that should be managed with care.

- Rapid Obsolescence of Technology

Inefficiency by necessity – Frequent efficiency improvements can make older production lines less competitive.

- Volatility of Raw Material Prices

The price of silicon and wafers fluctuates quite a lot and has an impact on margins.

- Policy and Duty Changes

Changes in import duties, PLI guidelines or certification rules can have an impact on profitability.

- Intense Global Competition

Large global manufacturers with scale advantages create a danger because they can reduce product prices.

Strategic planning, phased capacities expansion and diverse market exposure can reduce these risks.(Solar Cell Manufacturing in India)

Future Outlook: 2026–2030

India is well placed to become a key global solar manufacturing hub by 2030.

With:

- Strong domestic installation demand 4.

- Increasing manufacturing capacity

- Continued policy support

- Growing opportunities for exports

The ecosystem will probably reach maturity very quickly in the next five years.

Manufacturers that emphasize advanced technologies, international certifications, financial discipline and vertical integration will be best positioned to take market share.

The shift from import dependency to domestic self-reliance is a structural opportunity that has the potential to alter the renewable energy scenario in India.(Solar Cell Manufacturing in India)

Conclusion

India’s solar cells market has gone from being a nascent industrial sector to becoming a strategic manufacturing sector, a vital part of national energy security and economic growth.

With over 135 GW of installed solar capacity and lofty renewable targets to come, long-term demand fundamentals are strong. Government incentives, global supply chain shifts and domestic industrial expansion also strengthen the growth trajectory.

While capital intensity and technological change are challenges, the sector presents a great long-term opportunity for investors, manufacturers and entrepreneurs willing to operate on a grand scale with high-efficiency technologies.

India’s solar cell industry is no longer an emerging opportunity – it’s an industrial and energy foundation of the country.(Solar Cell Manufacturing in India)

Frequently Asked Questions (FAQ)

What is the size of India’s solar cell market today?

India has more than 135 GW of installed solar capacity, and domestic solar cell manufacturing capacity of around 35-40 GW.

Is solar cell manufacturing profitable in India?

Yes especially for large-scale and high-efficiency operations. Profitability is improved through vertical integration and good plant utilization.

Which schemes are there for solar manufacturing by the government?

Production-Linked Incentive (PLI) scheme and Adding to the List of Median and Marginal Small Manufacturers ALMM is one of the significant programs of the central government to support domestic manufacturers.

Which states are the best for solar manufacturing?

States such as Rajasthan and Gujarat have good infrastructure, solar ecosystems and access to exports.

What are the greatest risks in this industry?

Technology changes, volatility in raw material prices, and the global competitive environment are the risks that are to be planned with.

Can MSMEs enter the solar industry?

Yes, MSMEs can focus on component manufacturing, EPC services, distribution and recycling segments.